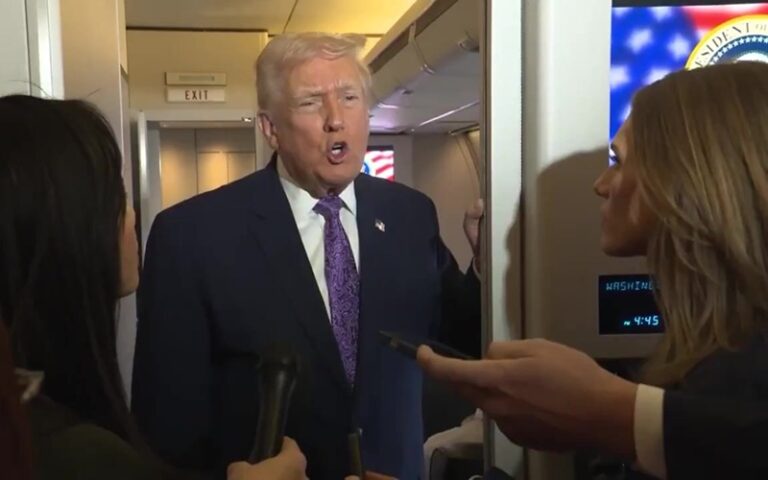

(Crankers) President Trump continues to push his plan to reimburse Americans for tariff dividends in 2026.

Trump claimed the administration anticipates a record tax refund season next year and rejected worries about affordability as a “Democrat scam.”

According to Trump, the United States has collected trillions of dollars through tariffs, and he plans to reduce the national debt and return a portion of that money to the people.

Trump also suggested that tariff revenue could eventually become large enough to replace income taxes. He said the government could eliminate income taxes or reduce them to much lower levels, although he did not outline a specific policy.

But the government projections differ from Trump’s claims. The Congressional Budget Office reduced its estimate of tariff revenue for the next decade from $3.3 trillion to $2.5 trillion. The revised projection would add about $500 billion in federal interest costs, bringing the total projected value of tariff revenue to roughly $3 trillion.

Budget analysts and economists question whether tariff dividend checks are financially realistic. Critics note that tariff revenue is unpredictable and that distributing nationwide refunds could be costly. The Committee for a Responsible Federal Budget estimates that Trump’s tariff policies will raise about $300 billion per year, while one round of dividend payments would cost about $600 billion. The group argues that any extra tariff revenue should be used to reduce federal deficits rather than fund rebate checks.

Since July, Trump has talked about paying $2,000 in tariff checks to groups of Americans making under a certain income.